1031 Tax Deferred Exchange - Tax Section 1031 Exchange

OVERVIEW

1031EXCHANGE.USLEGAL.COM RANKINGS

Date Range

Date Range

Date Range

LINKS TO BUSINESS

WHAT DOES 1031EXCHANGE.USLEGAL.COM LOOK LIKE?

1031EXCHANGE.USLEGAL.COM HOST

SERVER OPERATING SYSTEM AND ENCODING

I diagnosed that this domain is implementing the Apache/2.4.6 (CentOS) PHP/5.4.16 os.TITLE

1031 Tax Deferred Exchange - Tax Section 1031 ExchangeDESCRIPTION

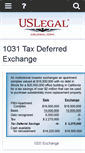

Raquo; Tax Section 1031 Exchange Home. Raquo; 1031 Tax Deferred Exchange. 1031 Tax Deferred Exchange. A tax-deferred exchange is simply a method by which a property owner trades property for other like-kind property and has the ability to defer any capital gain or loss which would be realized upon a sale. Section 1031 of the Internal Revenue Code allows up to 100 percent deferral of the realized gain. Inside 1031 Tax Deferred Exchange. 26 U S C Section 1031. About James L. Davis. 26 U S C Section 1031.CONTENT

This website had the following in the homepage, "Raquo; Tax Section 1031 Exchange Home." Our analyzers viewed that the web page stated " Raquo; 1031 Tax Deferred Exchange." The Website also said " A tax-deferred exchange is simply a method by which a property owner trades property for other like-kind property and has the ability to defer any capital gain or loss which would be realized upon a sale. Section 1031 of the Internal Revenue Code allows up to 100 percent deferral of the realized gain. Inside 1031 Tax Deferred Exchange. 26 U S C Section 1031. 26 U S C Section 1031."SUBSEQUENT WEB SITES

8230; should the blog posts on the former site get transferred over to the new blog or should the new blog start with a clean slate? Filed under RE News. 1 Ever since 1031 Exchange Coordinators.

You Can Trust Us With Your Exchange! Steps In An Exchange. Change In Use Of Property. What Is a 1031 Exchange? You Can Trust Us With Your Exchange! What is a 1031 Exchange? When property is sold. The seller pays tax on any gain or deducts a loss. Section 1031 of the tax code gives taxpayers an opportunity to defer any gain on the sale of qualified property.

Connect you with a Qualified Intermediary. Assist you in finding all 1031 replacement property options. Educate you on how oil and gas properties can qualify. Find you a qualified 1031 Exchange RE Agent or Broker. Help you locate a professional 1031 Attorney or Accountant. Due to the fact that excha.

Content on this page requires a newer version of Adobe Flash Player. Content on this page requires a newer version of Adobe Flash Player. Fully FDIC-Insured exchange accounts available. Access to qualified tax and real estate professionals. Licensed Attorney reviewing every exchange agreement. 30 years cumulative industry experience. See the latest Net Lease Advisor Newsletter.